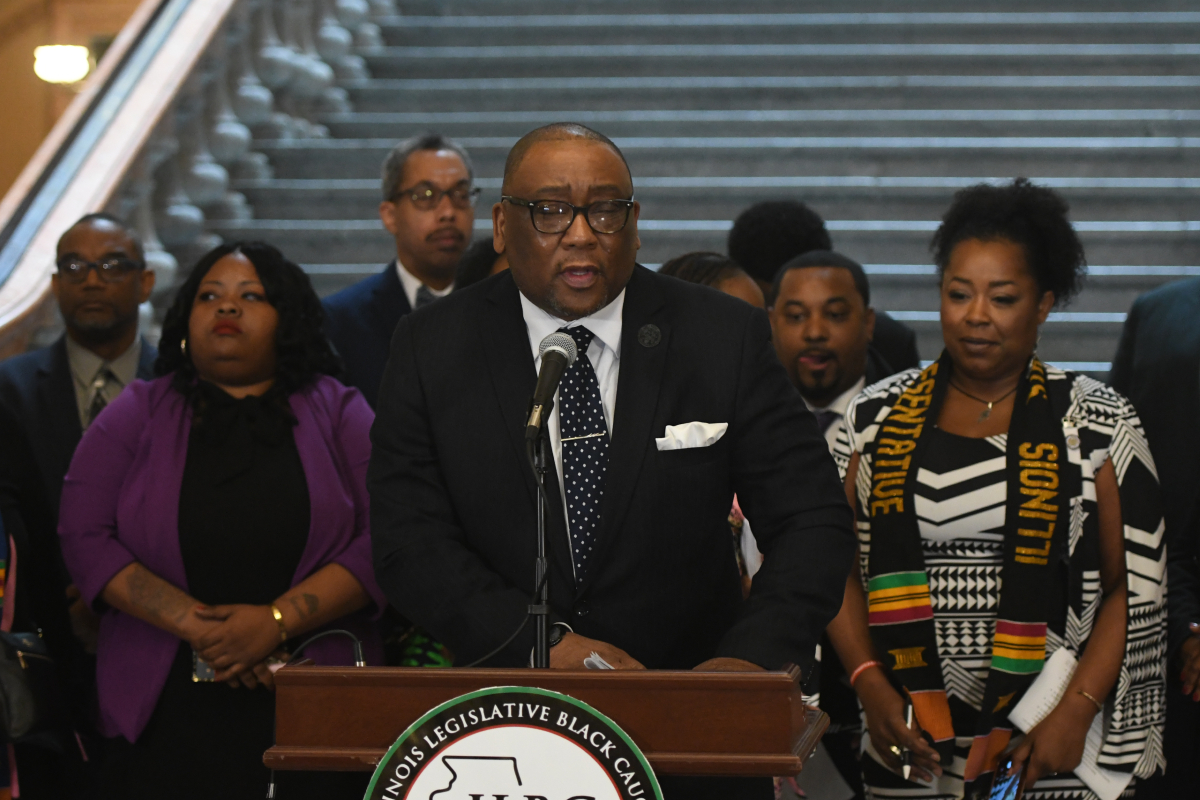

SPRINGFIELD – A new law led by State Senator Christopher Belt will identify and correct inequities some individuals face when seeking loans, mortgages or other financial services.

SPRINGFIELD – A new law led by State Senator Christopher Belt will identify and correct inequities some individuals face when seeking loans, mortgages or other financial services.

“Unfair lending practices undermine the financial stability of our communities,” said Belt (D-Swansea). “This new law is the first step toward enacting stronger protections to ensure every borrower is treated with fairness and respect.”

The new law builds off previous legislation that incentives state-regulated financial institutions to meet the financial service needs of areas where there is a lack of access to affordable banking, credit for small businesses, reasonable interest rates, mortgages and other lending services.

Under the law, the Illinois Department of Financial and Professional Regulation would be required to conduct studies to identify areas in Illinois that show significant disparities in relation to race, ethnicity, gender and other protected characteristics in the area of financial services. The law will also identify policies and procedures that may have discriminatory effects on underserved communities.

“There is no good reason that people are being denied basic banking and financial services, and we cannot continue to let this happen,” said Belt. “I will always be a strong advocate for economic equity, ensuring every resident in the state has the opportunity to succeed.”

Senate Bill 3235 takes effect Jan. 1, 2025.

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus