- Details

- Category: Senator Patrick Joyce News

SPRINGFIELD – To protect Illinois’ working class, State Senator Patrick Joyce (D-Essex) supported a constitutional amendment that would ban “right-to-work” legislation in Illinois.

SPRINGFIELD – To protect Illinois’ working class, State Senator Patrick Joyce (D-Essex) supported a constitutional amendment that would ban “right-to-work” legislation in Illinois.

“Right-to-work laws are a threat to Illinois workers and are extremely dangerous to workers’ basic rights on the job,” Joyce said. “This proposed constitutional amendment shows our support to unions, and all workers across the state, by giving them the opportunity to earn a living wage and work in good conditions.”

The amendment would provide that no law passed may prohibit the ability of workers to collectively bargain over wages, hours, terms and conditions of work. The measure would effectively ban right-to-work laws in Illinois, which prohibit union security agreements in which an employer and a labor union agree on the extent to which employees are compelled to join the union and pay union dues.

Non-members in a collective bargaining unit still receive the benefits of collective bargaining agreements, including the higher wages and benefits that unions earn through the bargaining process. Right-to-work laws effectively serve to increase the non-member proportion of the labor force, reducing the bargaining power of the collective.

“Workers in all industries should have the right to organize and bargain for better wages and conditions,” Villivalam said. “Illinois is one of the last bastions of the labor movement, and we must act to preserve and protect it.”

Senate Joint Resolution Constitutional Amendment 11 passed the Illinois Senate and awaits consideration in the Illinois House.

- Details

- Category: Senator Ram Villivalam News

SPRINGFIELD – To uphold the rights of working people, State Senator Ram Villivalam (D-Chicago) introduced a Constitutional amendment that would ban “Right to Work” legislation in Illinois.

SPRINGFIELD – To uphold the rights of working people, State Senator Ram Villivalam (D-Chicago) introduced a Constitutional amendment that would ban “Right to Work” legislation in Illinois.

“Workers in all industries should have the right to organize and bargain for better wages and conditions,” Villivalam said. “Illinois is one of the last bastions of the labor movement, and we must act to preserve and protect it.”

The amendment would provide that no law passed may prohibit the ability of workers to collectively bargain over wages, hours, terms and conditions of work. The measure would effectively ban “Right to Work” laws in Illinois, which prohibit union security agreements in which an employer and a labor union agree on the extent to which employees are compelled to pay for the administering of collective bargaining.

- Details

- Category: Senator Cristina Castro News

ELGIN – State Senator Cristina Castro (D-Elgin) announced this week that local communities would be receiving more than $9 million in funding from the Illinois Department of Transportation’s Multi-Year Improvement Program to develop state highways in the area.

“I’m proud to have worked with local leaders and IDOT to secure funding for these projects,” Castro said. “As our state begins to open back up, these road improvements will ensure locals and visitors alike experience safe and easy travel around our community.”

Upgrades will consist of rehabilitating about seven miles of road along Illinois 19 and Illinois 58 in Elgin and Streamwood. The upgrades are a part of IDOT’s six year program to maintain and expand Illinois’ transportation infrastructure.

- Details

- Category: Senator Mike Simmons News

CHICAGO – State Senator Mike Simmons (D-Chicago) announced Friday that $2.5 million in construction projects in the 7th Illinois Senate District will improve roads and make accessibility improvements as part of the Illinois Department of Transportation’s multi-year construction plan.

“These projects represent some much-needed improvements to major arterial streets in the 7th District,” Simmons said. “These improvements will upgrade our roads, make sure the streets and sidewalks are accessible for pedestrians and people living with disabilities, and generate good jobs at the same time.”

Read more: Simmons announces $2.5 million road improvements plan for the 7th District

- Details

- Category: Senator Robert Peters News

SPRINGFIELD – The Illinois Department of Transportation unveiled its multi-year plan earlier this week, and State Senator Robert Peters (D-Chicago) is pleased to announce that it includes more than $75 million for local projects.

“Heavily trafficked roads and bridges are an extremely important area for our city that too often gets overlooked, so it’s good to know that IDOT is making much needed improvements,” Peters said. “Some of the roads and bridges in the plan this year are in bad shape and have needed repairs for years.”

Read more: Peters announces over $75 million in funding for local roads and bridges

- Details

- Category: Senator Celina Villanueva News

SPRINGFIELD – To uphold the rights of working people, State Senator Celina Villanueva (D-Chicago) voted in favor of a Constitutional amendment that would ban “Right to Work” legislation in Illinois.

SPRINGFIELD – To uphold the rights of working people, State Senator Celina Villanueva (D-Chicago) voted in favor of a Constitutional amendment that would ban “Right to Work” legislation in Illinois.

“Right to Work laws serve to dismantle the labor movement and don’t offer working families better wages or conditions,” Villanueva said. “As a former union steward, I proudly support this amendment.”

The amendment would provide that no law passed may prohibit the ability of workers to collectively bargain over wages, hours, terms and conditions of work. The measure would effectively ban “Right to Work” laws in Illinois, which prohibit union security agreements in which an employer and a labor union agree on the extent to which employees are compelled to join the union and pay union dues.

Non-members in a collective bargaining unit still receive the benefits of collective bargaining agreements, including the higher wages and benefits that unions earn through the bargaining process. “Right to Work” laws effectively serve to increase the non-member proportion of the labor force, reducing the bargaining power of the collective.

Senate Joint Resolution Constitutional Amendment 11 passed the Illinois Senate and awaits consideration in the Illinois House.

Villanueva apoya prohibir las leyes “Right to Work”

SPRINGFIELD – Para proteger los derechos de la clase trabajadora, la Senadora estatal Celina Villanueva (D-Chicago) votó a favor de una enmienda constitucional que prohibiría la legislación “Right to Work” (que permite que los trabajadores decidan contar o no con la protección de los sindicatos) en Illinois.

“Las leyes ‘Right to Work’ sirven para desmantelar el movimiento laboral y no ofrecen a las familias de clase trabajadora mejores condiciones salariales,” dijo Villanueva. “Como ex administradora sindical, apoyo con orgullo esta enmienda.”

El cambio constitucional estipularía que ninguna ley pueda prohibir la posibilidad de que los trabajadores negocien colectivamente sobre sus salarios, horas, términos y condiciones laborales. La medida prohibiría de facto las leyes “Right to Work” en Illinois, que prohíben los tratos en que un empleador y un sindicato acuerdan las condiciones en que los empleados puedan enrolarse en un sindicato y pagar las contribuciones correspondientes.

Quienes no son miembros de una unidad de negociación colectiva seguirán recibiendo los beneficios de los acuerdos en acuerdos colectivos, incluyendo ingresos más altos y otros beneficios que los sindicatos obtengan en las negociaciones. Las leyes “Right to Work” sirven para incrementar la fuerza laboral que decide no ser miembro, reduciendo la capacidad de negociación colectiva.

La Resolución de la Enmienda Constitucional 11 del Senado fue aprobada en el Senado de Illinois y espera ser considerada por la Cámara de Representantes.

- Details

- Category: Senator Rachelle Crowe News

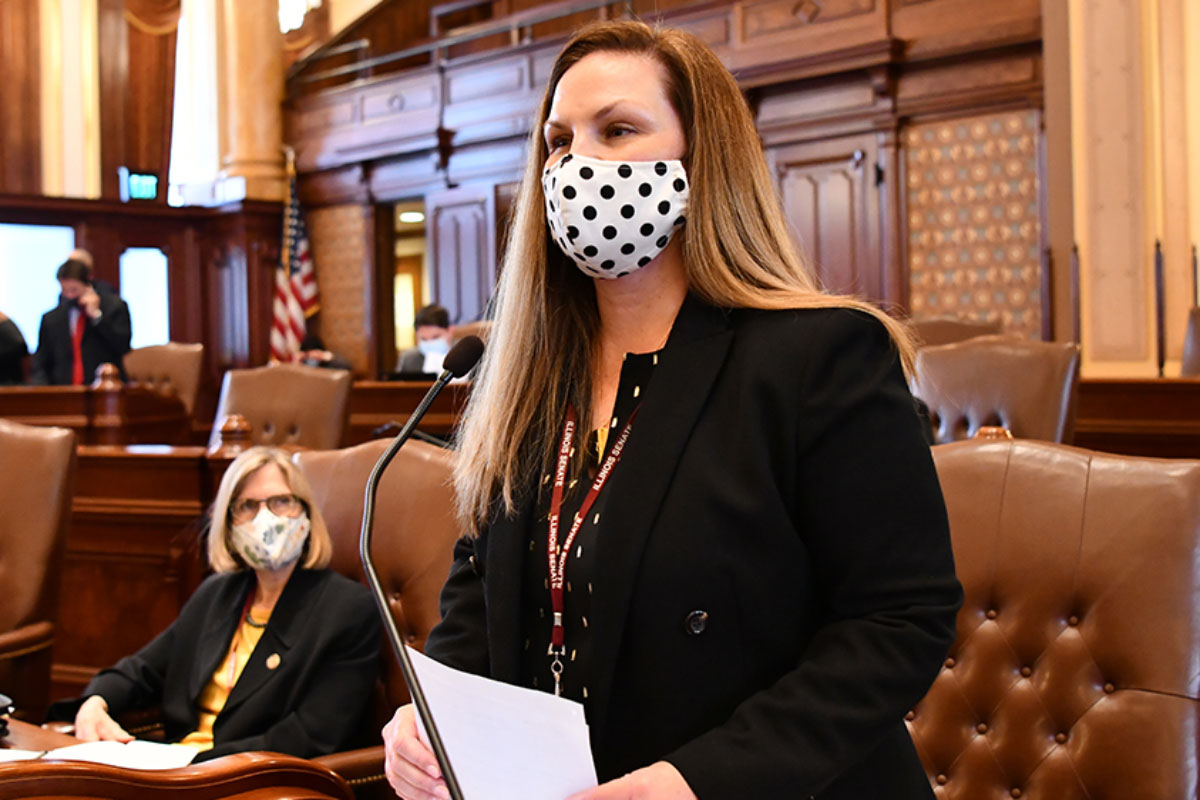

SPRINGFIELD – The Illinois Senate approved a plan supported by State Senator Rachelle Crowe (D-Glen Carbon) to constitutionally solidify collective bargaining rights for workers Friday.

SPRINGFIELD – The Illinois Senate approved a plan supported by State Senator Rachelle Crowe (D-Glen Carbon) to constitutionally solidify collective bargaining rights for workers Friday.

“Working families keep our businesses open, support our communities and develop our economies—they deserve to be able to negotiate their employment contracts,” Crowe said. “By ensuring their right to collective bargaining is protected by the Illinois Constitution, we are showing our respect for their local contributions.”

Crowe’s proposal amends the Illinois Constitution to prohibit legislative proposals from affecting workers’ rights set forth by the 2019 Collective Bargaining Freedom Act.

The Collective Bargaining Freedom Act ensured protections for middle-class families by allowing workers to negotiate wages, hours, terms and conditions with employers.

“By amending the Constitution, Illinois guarantees workers’ right to negotiate livable wages and safe working conditions,” Crowe said. “This amendment is an important gesture in support of the men and women who keep our state’s economy running.”

Senate Joint Resolution Constitutional Amendment 11 passed the Senate Friday.

- Details

- Category: Senator Adriane Johnson News

SPRINGFIELD – School districts could move forward from the pandemic without worrying about funding cuts due to temporary low enrollment under a measure sponsored by State Senator Adriane Johnson (D-Buffalo Grove), which has passed both chambers of the Illinois legislature.

SPRINGFIELD – School districts could move forward from the pandemic without worrying about funding cuts due to temporary low enrollment under a measure sponsored by State Senator Adriane Johnson (D-Buffalo Grove), which has passed both chambers of the Illinois legislature.

“Our teachers and administrators worked overtime to adapt to remote and hybrid learning during the COVID-19 crisis,” Johnson said. “To cut their funding now would be to pull the rug out from under them just when they are beginning to recover.”

Currently, the school funding formula uses average student enrollment over the previous three school years to determine the amount of money districts receive. To lessen the impact of the COVID-19 pandemic on schools’ budgets, Johnson’s legislation would allow school districts to calculate their average student enrollment based on pre-COVID levels.

Under the measure, districts could choose to use attendance records from the 2019-20 or the 2020-21 school year, whichever is greater, in their funding formulas to ensure they don’t lose out on crucial dollars as a result of the temporary drop in attendance some schools experienced during the pandemic.

“For many kids, school was a lifeline to the outside world during the pandemic,” Johnson said. “It’s important that our districts don’t miss out on a single cent as they make the transition back to the classroom.”

Senate Bill 813, an initiative of Waukegan School District #60, passed the Senate in April with bipartisan support and advanced out of the House Thursday with a vote of 75-39.

More Articles …

Page 485 of 769

© 2026 Illinois Senate Democratic Caucus

© 2026 Illinois Senate Democratic Caucus